Life sciences companies often face elevated risks due to the specialised nature of their equipment and operations, the complexity of their supply chains, and the regulatory environment in which they operate.

While companies in every industry can mitigate risk by developing, testing, and continually updating business continuity plans, it’s especially important for every life sciences company to maintain a detailed plan for responding to and recovering from events that impair operations. This plan should include input from leadership and management teams across the company, so that prevention, mitigation, and recovery strategies are holistic and coordinated

Understanding key risks as part of your business continuity planning

Like companies in other sectors, life sciences companies can be disrupted by a range of adverse events, including:

- Natural disasters or severe weather events

- Direct physical loss or damage to facilities including fires or water damage

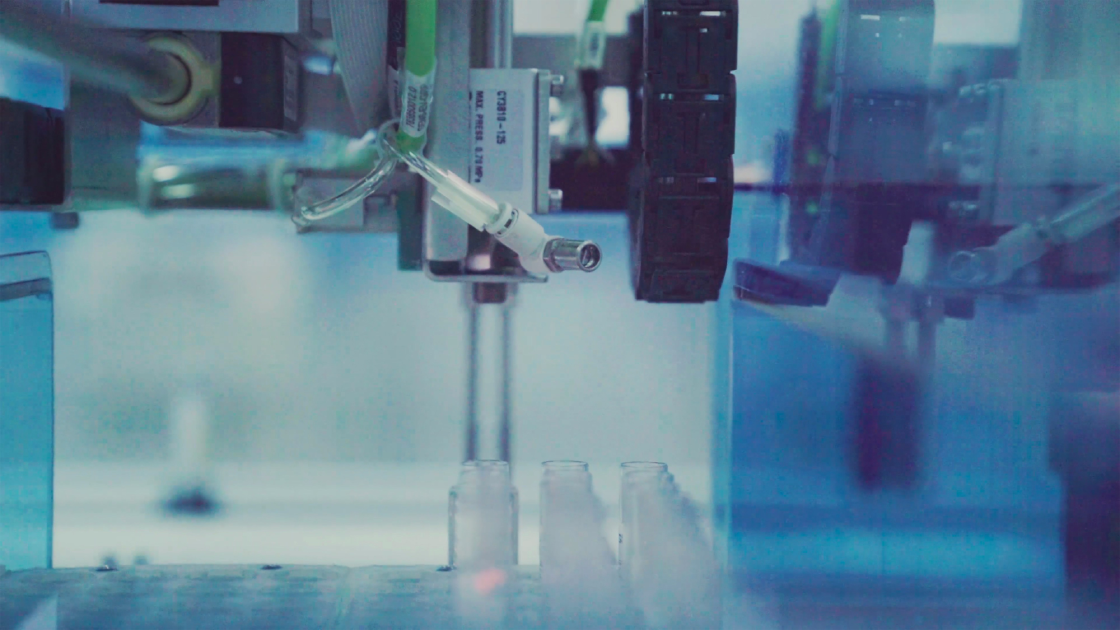

- Equipment breakdowns

- IT failures and cyber security incidents

- Supply chain disruptions

Even more pronounced, life sciences companies may need more time and incur greater expenses to recover from disruptions than average. For example, opening a replacement production facility or qualifying a new supplier may be delayed because of the need to meet regulatory requirements or obtain regulatory authorisation specific to the life sciences sector. Specialised research materials, such as cell lines, or specialised product components, may be difficult to replace quickly.

Business continuity planning should both identify key risks and accurately measure their potential impacts. For many life sciences companies, calculating lost profit is not sufficient. If a company is engaged in significant R&D—or is solely focused on R&D as an early-stage company—it may need insurance to protect these unique operations even though R&D generally does not generate direct product revenue. There are Business Income including R&D Income worksheets available to assist in valuing your business interruption insurance needs.

In addition to identifying and measuring risks, your business continuity plan should include detailed steps for recovering from the greatest range of disruptions. Train employees on implementing the plan and conduct regularly scheduled tests to determine if your plan remains current and effective, and where it may need updating. It should be a living, breathing document.

Mitigating supply chain risks in the life sciences sector

Supply chain dependencies and complexity can be risk multipliers. Life sciences companies may rely on dozens of domestic and international suppliers to maintain their operations. While there may be many sources for some raw materials, specialised ingredients, equipment, and parts may be available from only one or a few suppliers.

The nature of life sciences supplies can also increase risks of supply chain disruption. Some materials can be rendered unusable by changes in temperature or excessive vibrations during transportation. Personnel shortages or regulatory changes can also impact supply chains.

There are many steps that life sciences companies can take to help mitigate supply chain risks, including creating supply chain redundancies, and easing just-in-time processes. While not every step will be applicable to every company, here are five approaches to consider:

- Identify and validate back-up suppliers—including suppliers located in different geographies to account for potential localised catastrophes.

- Identify, test, and utilise alternative logistics routes.

- Increase inventory of supplies—and store supplies at multiple locations.

- Explore using alternative ingredients or reducing the number of ingredients and materials used in production.

- Evaluate and potentially enhance supply chain technology.

While supply chain redundancies can add costs, they can also help mitigate business interruption losses. Keep in mind too that implementing these steps can create new risks that require additional loss controls. For example, storing inventory in various geographies can increase exposure to regional national catastrophe events and loss of inventory values; or expanding supply chain technology can create new cyber risks.

In addition, consider working with tier one suppliers to strengthen their supply chain resilience. Ask your suppliers about their own business continuity planning.

Seek expert guidance and the right insurance partner

Life sciences companies should seek out insurers with strong sector expertise. The best insurers will provide more than basic insurance policy coverage and claims servicing; they will also work as a partner in helping you understand your specific risks, calculate potential impacts, and scope a business continuity plan. Ask your insurance agent or broker for guidance on potential insurers and coverages they offer. Particularly, you will want to know if they provide the following coverage and benefits for life sciences companies:

- Business income period of indemnity contemplating full operational restoration to pre-loss levels, with adequate indemnity periods.

- Business income and extra expense formula to accommodate R&D, regardless of revenue generation.

- Worldwide contingent business interruption coverage for losses incurred when suppliers suffer physical loss or damage, thereby impairing your operations.

- Include Ordinary Payroll so you can continue to pay your employees their traditional wages during your downtime and recovery period.

- By-Law, Ordinance or Law included in the period of restoration for applicable new zoning, land use, or building regulations.

- Risk engineering services aligned with life sciences operations and expertise in business continuity plan development.

All content in this material is for general information purposes only. It does not constitute personal advice or a recommendation to any individual or business of any product or service. Please refer to the policy documentation issued for full terms and conditions of coverage.

Chubb European Group SE (CEG) is an undertaking governed by the provisions of the French insurance code with registration number 450 327 374 RCS Nanterre. Registered office: La Tour Carpe Diem, 31 Place des Corolles, Esplanade Nord, 92400 Courbevoie, France. CEG has fully paid share capital of €896,176,662. UK business address: 40 Leadenhall Street, London, EC3A 2BJ. Authorised and supervised by the French Prudential Supervision and Resolution Authority (4, Place de Budapest, CS 92459, 75436 PARIS CEDEX 09) and authorised and subject to limited regulation by the Financial Conduct Authority. Details about the extent of our regulation by the Financial Conduct Authority are available from us on request.

Insights and expertise