How much do medical repatriations cost?

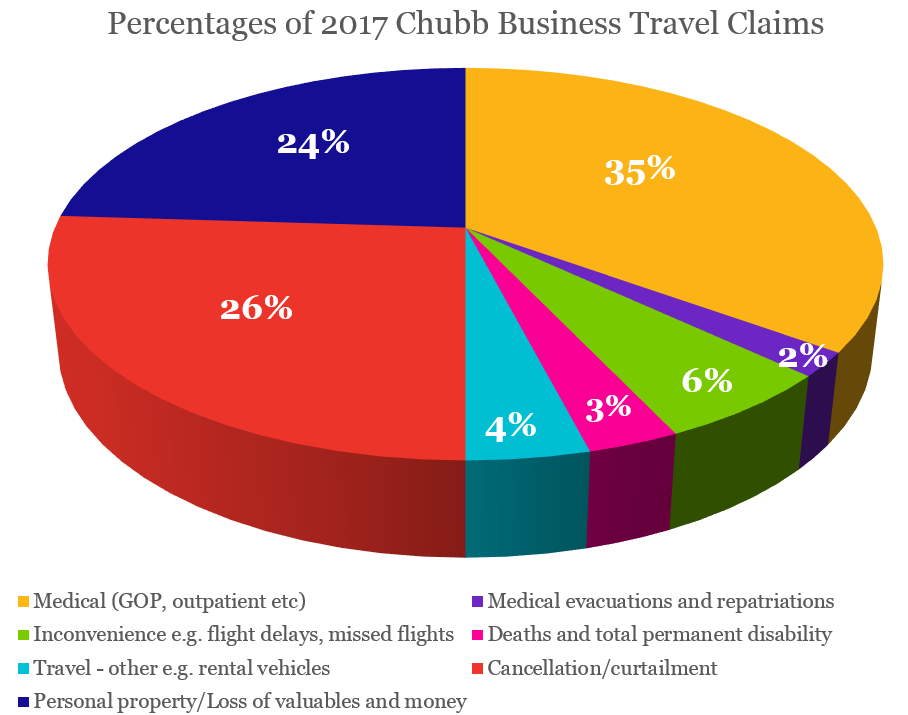

Medical claims continue to top the number of claims recorded by Chubb in 2017 for Business Travel Insurance policies. While medical evacuations and repatriations form only a small percentage in comparison, their usually high cost may be covered by a group business travel insurance policy.

All businesses, small and large, have an obligation to look after their employees and mitigate the risks they face while at work, or traveling on business, or on secondment. When employees fall seriously ill or are badly injured on their business travels, a medical evacuation to the nearest centre of medical excellence or repatriation back to their home country for further treatment is often their best chance of a positive outcome. Chubb’s 24-hour assistance partners enable insured business travelers to travel with confidence knowing that help following a covered loss is just a phone call away.

Here are four recent cases to show how Chubb has delivered emergency assistance in various countries.

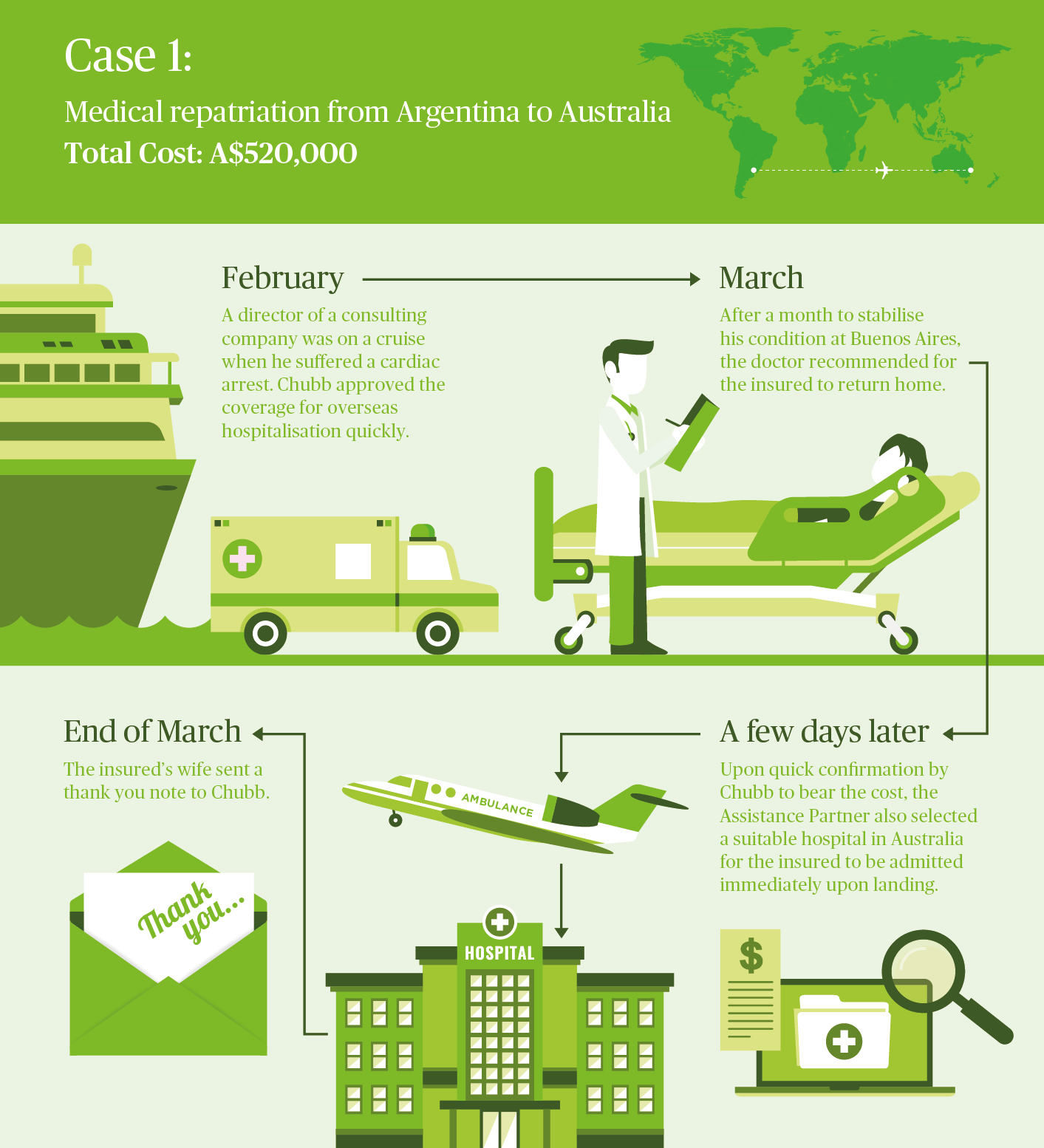

Case 1

Medical repatriation from Buenos Aires, Argentina to Australia

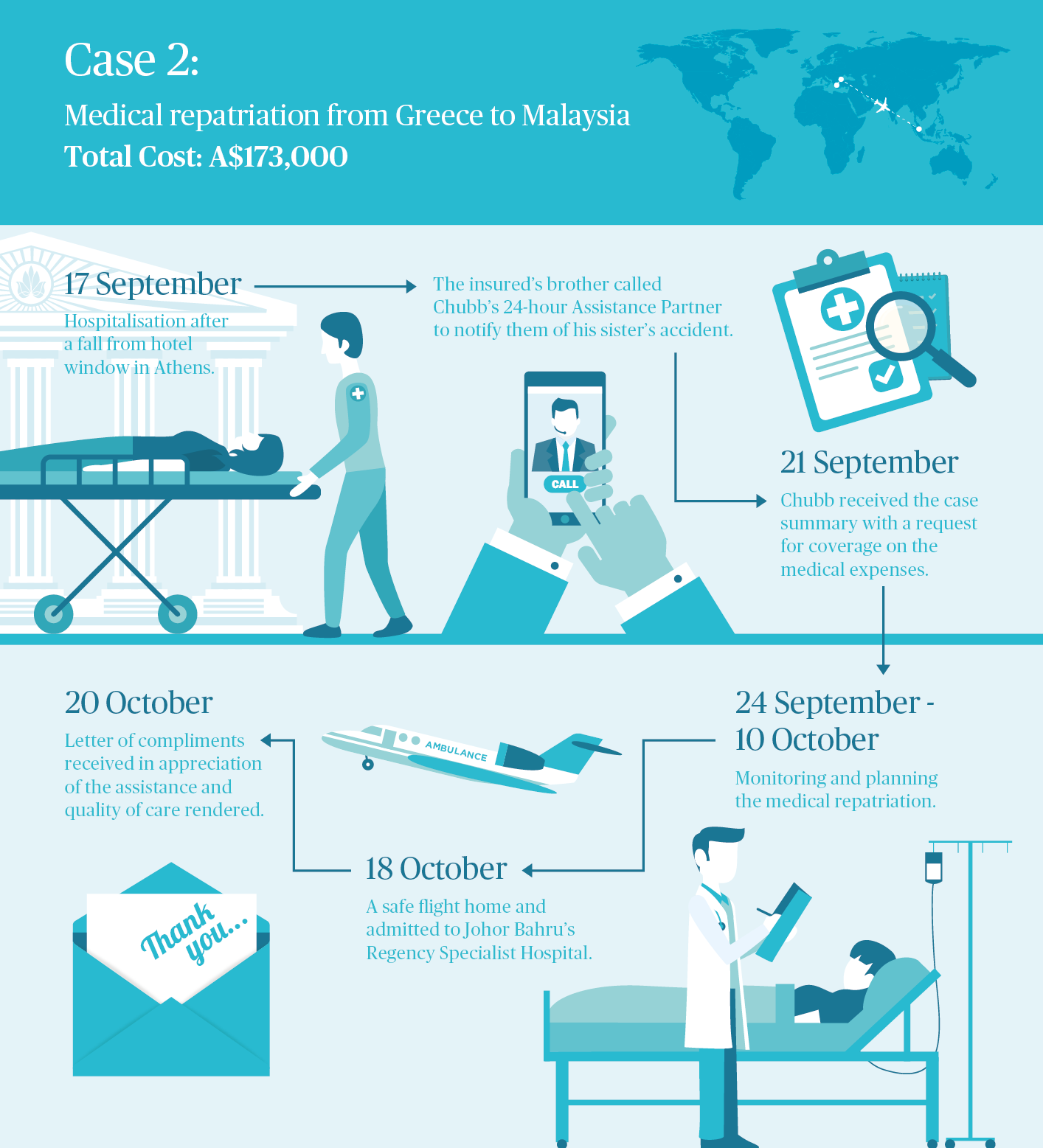

Case 2

Medical repatriation from Greece to Malaysia

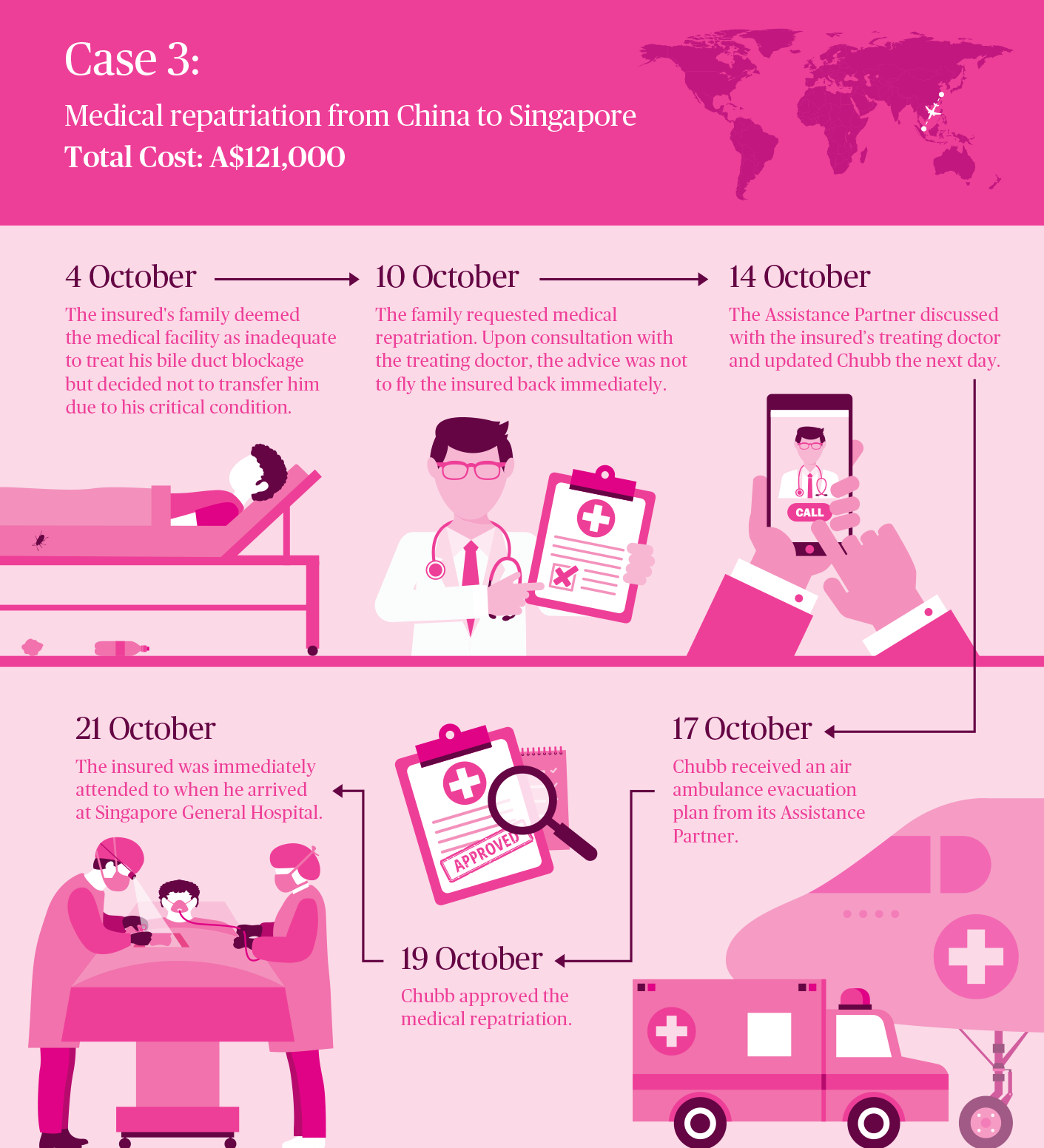

Case 3

Medical repatriation from China to Singapore

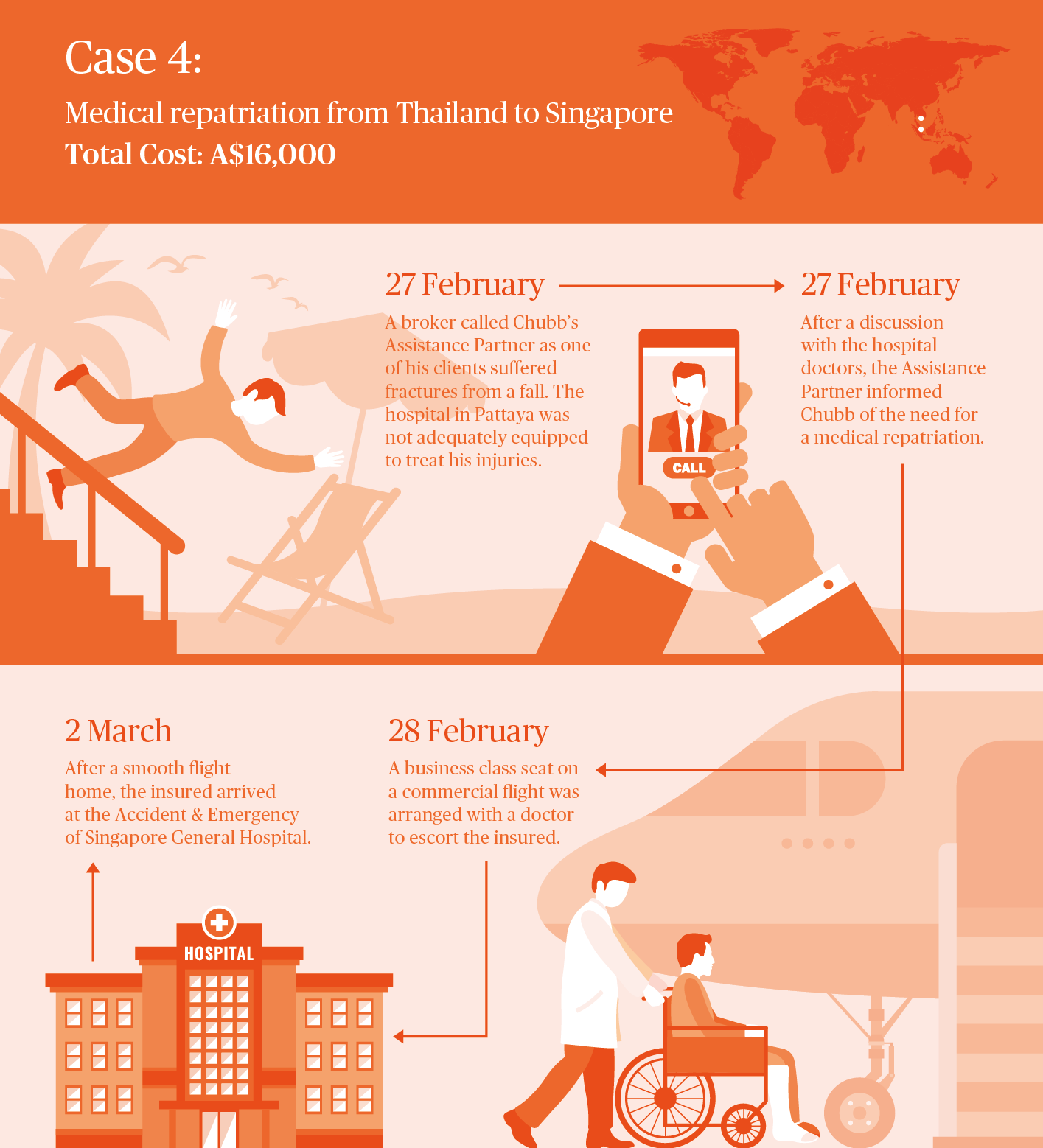

Case 4

Medical repatriation from Pattaya, Thailand to Singapore

This content is brought to you by Chubb Insurance Australia Limited (“Chubb”) as a convenience to readers and is not intended to constitute advice (professional or otherwise) or recommendations upon which a reader may rely. Any references to insurance cover are general in nature only and may not suit your particular circumstances. Chubb does not take into account your personal objectives, financial situation or needs and any insurance cover referred to is subject to the terms, conditions and exclusions set out in the relevant policy wording. Please obtain and read carefully the relevant insurance policy before deciding to acquire any insurance product. A policy wording can be obtained at www.chubb.com/au, through your broker or by contacting any of the Chubb offices. Chubb makes no warranty or guarantee about the accuracy, completeness, or adequacy of the content. Readers relying on any content do so at their own risk. It is the responsibility of the reader to evaluate the quality and accuracy of the content. Reference in this content (if any) to any specific commercial product, process, or service, and links from this content to other third party websites, do not constitute or imply an endorsement or recommendation by Chubb and shall not be used for advertising or service/product endorsement purposes. ©2020 Chubb Insurance Australia Limited ABN: 23 001 642 020 AFSL: 239687. Chubb®, its logos, and Chubb.Insured.SM are protected trademarks of Chubb.

Have questions?

Contact a broker today.