Commissioning a new life sciences facility: 7 aspects to consider

Written by

Head of Middle Market and Industry Practices, Chubb Overseas General

Senior Risk Engineer, Chubb Risk Engineering Services

Demand for life sciences facilities, such as manufacturing plants, specialist warehousing or research and development facilities, is extremely high in the UK and Europe and far outstrips supply 1. Many life sciences companies plan to commission and open new facilities, either new builds or renovations. This article outlines some of Chubb’s risk engineers’ recommendations that can help to mitigate risk.

1. Site selection

Consider choosing a location with timely fire brigade response and with adequate supplies of fire-fighting water. Additionally, it may be advisable to carefully consider the natural catastrophe risk and the presence of any other exterior exposures, such as higher-risk neighbouring properties.

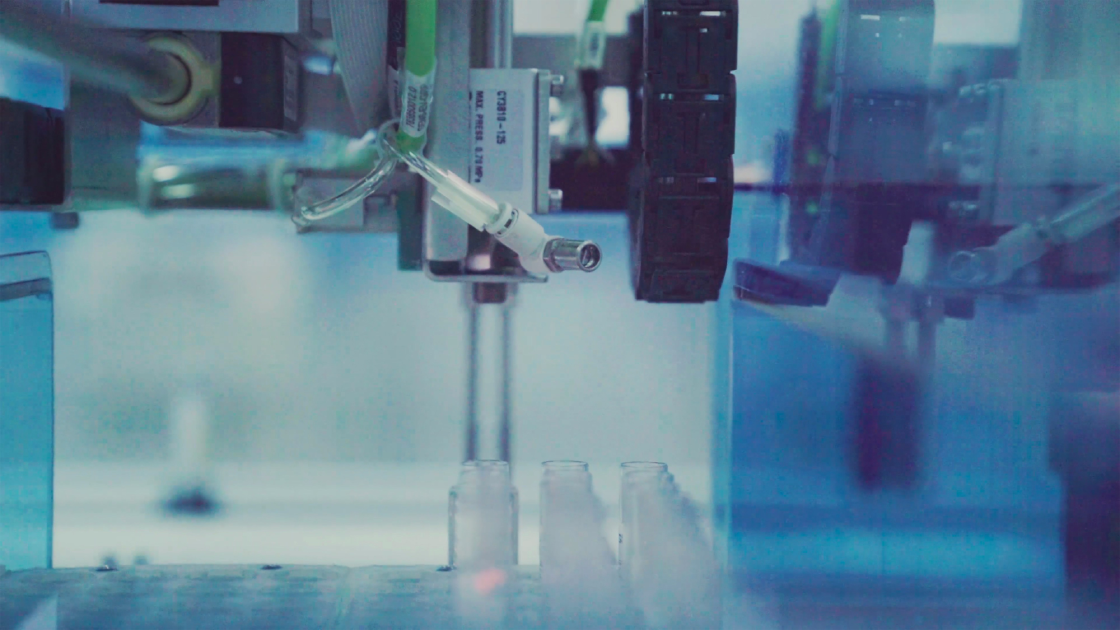

2. Process architecture

Think about matching the design and layout of the building with the business’s manufacturing processes, encompassing the different requirements along the production line. Well-aligned, contiguous processes can help with production efficiency and minimise potential operational risk.

3. Construction

Non-combustible, or preferably fire-resistive construction materials should be used, both for the building itself and for any structures (cleanrooms, cold stores) within. Particular attention should be paid to the combustibility of any insulation material. Clients and brokers can receive further information about this from their insurance partner.

4. Fire and smoke detection and suppression systems

The early detection of fire may mean the difference between an event that can be minimised and a catastrophic incident. Fire and smoke detection linked to an emergency response could be critical in this respect. If considering suppression systems, including sprinklers, approaching your insurer for advice is strongly suggested. There should be a well thought out fire strategy that incorporates how all elements of fire detection, compartmentation, suppression and human intervention work together.

5. Fire and smoke compartmentation

Plant or processes that could cause uncontrolled fire or smoke should be separated from assets that may be highly sensitive to such contamination. Positive pressure in cleanrooms and fire dampers in ductwork are two examples of controls that could be put into place to mitigate smoke contamination.

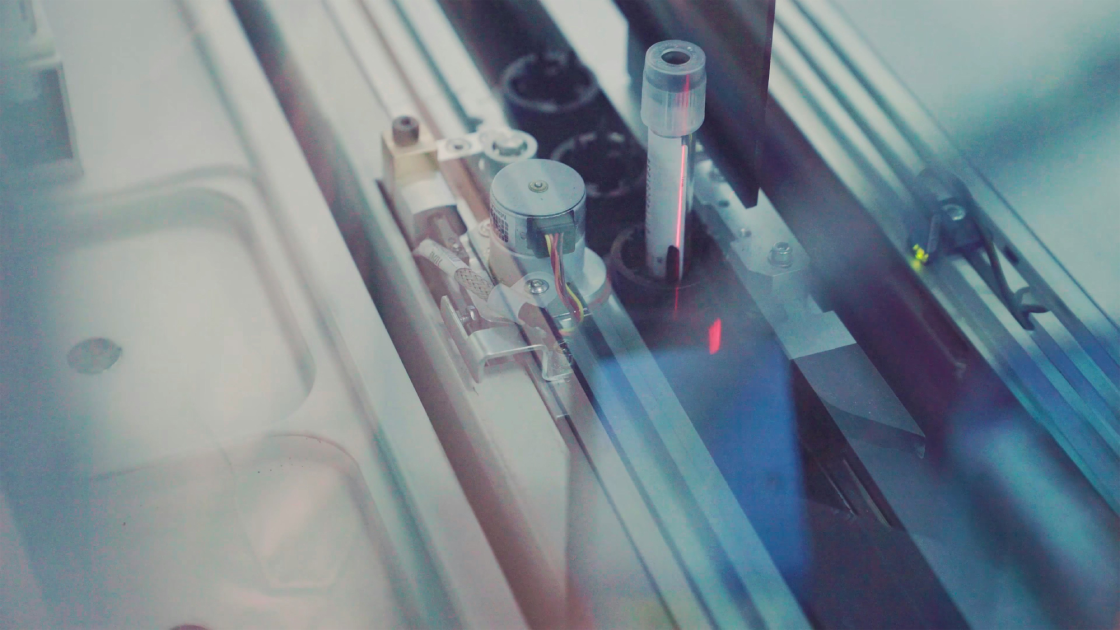

6. Plant and equipment

In a Life Science environment, redundancy of plant and equipment can be critical, ensuring that important functions and processes are maintained in an operational state. Spare parts should be present, and a planned preventative maintenance schedule be in place.

7. Water damage protection

Even a small amount of water leakage can have a huge impact on operations, so it’s advisable to consider the location of water pipes, drainage systems and the accessibility of isolation valves. Best practice would be installing a liquid detection system in vulnerable areas. Best practice would also include an emergency response plan that incorporates actions to reduce further water intrusion, to remove existing water and to move or protect any plant, equipment stock etc that could be vulnerable. A timely response could be business critical.

Summary

This article outlines just some of the risk management actions that Chubb’s risk engineers would highlight to life sciences companies looking to renovate or build a new facility. We recognise that every client presents different risk exposures. Our Risk Engineering team welcome the opportunity to work alongside our clients and broker partners to offer bespoke risk solutions.

Specialising in Life Sciences for over 25 years, Chubb offers specialist products, supported by underwriters, risk engineers and claims handlers who are industry specialists. From product liability and clinical trials to professional indemnity, and property insurance to cyber and marine, we have it covered. We can support from the early R&D phase through to complex multinational. Contact us today to learn how you can partner with us to utilise our expertise and experience with the life sciences.

1 https://www.cbre.co.uk/insights/books/uk-real-estate-market-outlook-2024/life-sciences

Insights and expertise

All content in this material is for general information purposes only. It does not constitute personal advice or a recommendation to any individual or business of any product or service. Please refer to the policy documentation issued for full terms and conditions of coverage.

Chubb European Group SE trading as Chubb, Chubb Bermuda International and Combined Insurance, is authorised by the Autorité de contrôle prudentiel et de résolution (ACPR) in France and is regulated by the Central Bank of Ireland for conduct of business rules.

Registered in Ireland No. 904967 at 5 George's Dock, Dublin 1.

Chubb European Group SE is an undertaking governed by the provisions of the French insurance code with registration number 450 327 374 RCS Nanterre and the following registered office: La Tour Carpe Diem, 31 Place des Corolles, Esplanade Nord, 92400 Courbevoie, France. Chubb European Group SE has fully paid share capital of €896,176,662.