Protecting your lifestyle and valuables with Masterpiece

You’ve worked hard for your successes but have you ever thought about what you would do if an unforeseen incident happens?

How would your home, your lifestyle and assets of deep significance be impacted? The house you live in, the hobbies you enjoy, the possessions you’ve purchased or even that precious heirloom passed down from generation to generation.

These are the kinds of things that need to be properly protected and with Masterpiece® – a bespoke lifestyle policy, you can be assured of the level of protection you deserve.

To find out more on how you can protect your home and your lifestyle, check out the stories below featuring stories from our clients*.

*Names have been changed.

Story 1

Protect your lifestyle and the things you treasure

Being financially successful allows us to appreciate the finer things in life – rare wines, designer clothing, antiques, jewellery and more. As we acquire these valuables, such lifestyle choices become an integral part of our lives.

We take great care curating collections we call our own, how often do we think of protecting them?

Meet Rachel:

Story 2

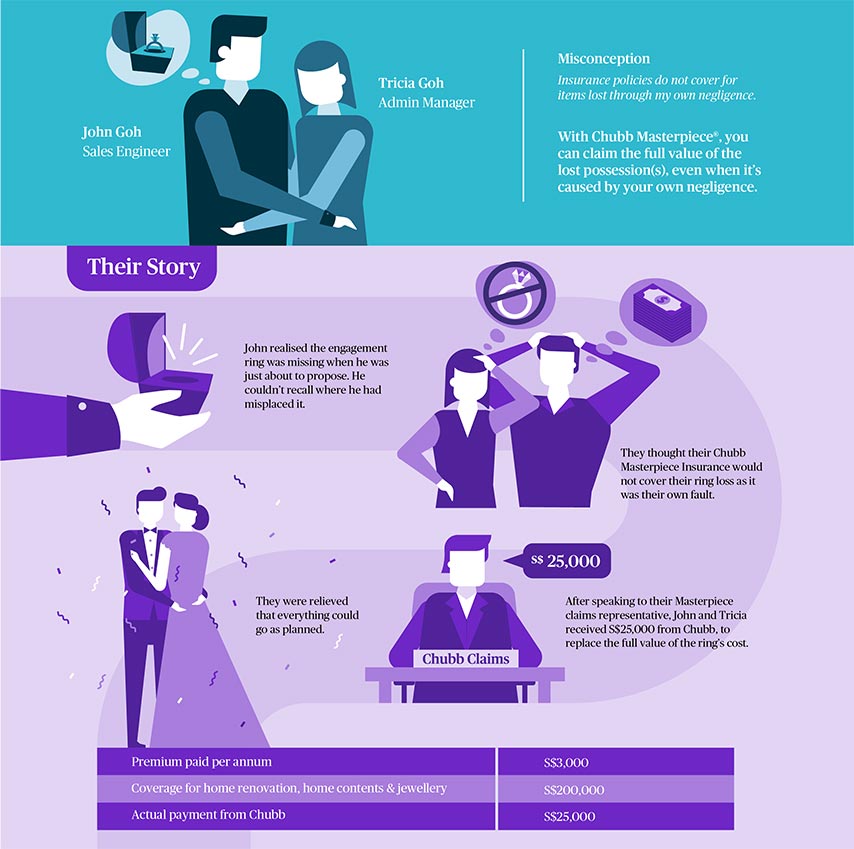

Protect your valuables and safekeep your memories

Jewellery, watches and bags are valuable possessions, a part of our life story. They may have been handed down generation after generation. Losing these valuables can feel like losing an important part of ourselves.

Our valuables hold so much sentimental worth, but are we protecting them sufficiently?

Meet John and Tricia:

Story 3

Protect your cashflow and safeguard your golden years

Our golden years is the time when we should pamper ourselves and enjoy life to the fullest. Whether it is investing in a new house, indulging in our lifestyle habits or taking a round-the-world trip, we need adequate cash liquidity to make our retirement a reality.

We work hard in our younger days, but are we doing enough to safeguard our cashflow for a comfortable retirement?

Meet Ian and Kylie:

No part of this article may be reproduced in any written, electronic, recording, or printed form without written permission of Chubb.

Disclaimer - The content of the above article is not intended to constitute professional advice. Although all content is believed to be accurate, Chubb Insurance Singapore Limited (Chubb) makes no warranty or guarantee about the accuracy, completeness, or adequacy of the content of this article. Users relying on any content do so at their own risk.

Protect your home and valuables

Get a quote online or leave your contact details and our representatives will get in touch with you.