- Individuals & Families

- Businesses

- Agents & Brokers

- Embedded Insurance

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Chubb ranked #1 for Customer Satisfaction with the Home Insurance Claims Experience

Because pets are family, Chubb now offers pet insurance with top-rated coverage from Healthy Paws.

Chubb offers the insurance protection you need for travel’s many “what ifs”.

Chubb protects small businesses at every stage – from newly formed start-ups to long-time anchors of the community.

Stay ahead of cyber threats with our free Cyber Claims Landscape Report.

Learn more about our dedicated learning paths, Online Learning Center, and more.

Many digital-savvy consumers look for it as a core or add-on option.

Many digital-savvy consumers look for it as a core or add-on option.

Many digital-savvy consumers look for it as a core or add-on option.

Chubb’s in-house technology makes it easy to integrate what we do into your customer experience.

-

About

-

Claims

-

Login & Pay Bill

For Agents & BrokersFor Travel Advisors

-

Back

Whether it’s caused by flammable materials, arson or mother nature, fire can pose a devastating threat to your commercial property. Indeed, according to the National Fire Protection Association (NFPA) there were 481,500 structure fires in the United States in 2019, causing $12.3 billion in property damage.1

Knowing the risks and having a fire prevention plan can make the difference between continuing business operations and financial collapse.

Common fire risks facing businesses

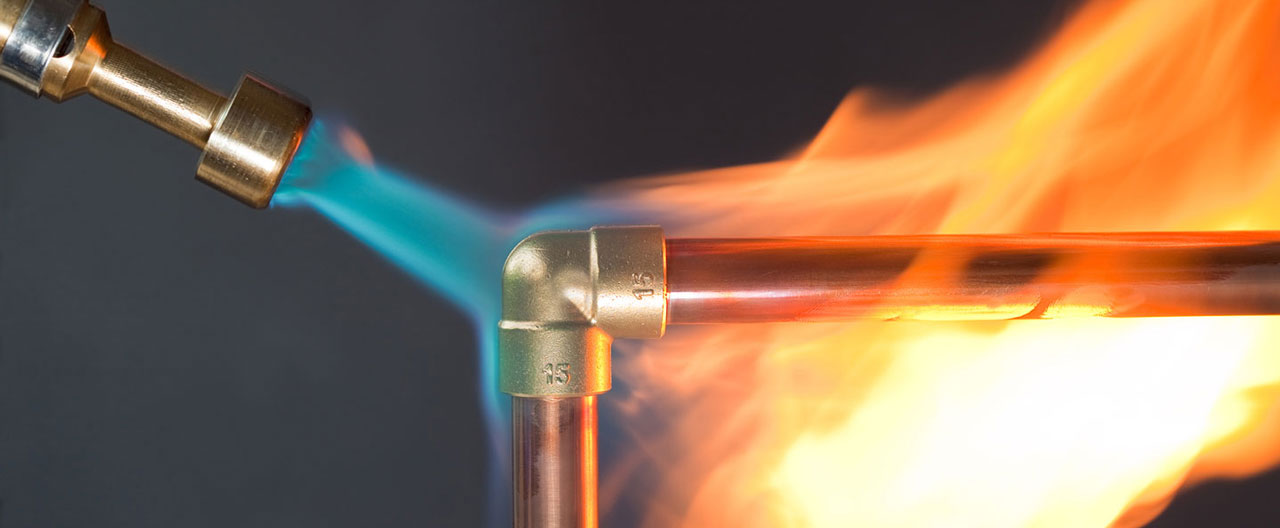

- Hot work: Work such as brazing, cutting, grinding, open-flame soldering, welding, and torching all fall under the term “hot work” and can ignite combustibles with disastrous results. Hot work operations introduce a variety of potential ignition sources that require strict supervision.

- Ignitable liquids: Fuels, solvents, thinners, cleaners, adhesives, paints, waxes, and polishes — common in many industrial facilities — are often flammable or combustible.

- Intentional fires: Deliberately set fires, also known as arson, are often costlier than accidental fires. This can be due to the business location being unoccupied at the time, the arsonist using several points of ignition, the deliberate impairment of fire alarms and sprinkler systems, or by the fire being accelerated by flammable liquids or other agents.

- Wildfires: Increasing temperatures, lower precipitation and humidity levels, and high winds are conspiring to cause more frequent and severe wildfires each year. In fact, recent studies predict that the number of large, high-intensity fire events will increase globally, in part due to a 20-50% increase in the number of days when conditions are conducive to fires.2

Fire mitigation for businesses

1. Install and maintain a fire detection system:

Modern technology can help prevent fires or limit the destruction caused by an ensuing fire so make sure to find the right system for your business:

- Local alarm systems notify building occupants through the notification appliances.

- Proprietary alarm systems are monitored at a constantly attended location within the facility where the system is located.

- Remote supervising stations provide monitoring at a constantly attended location under control of the building owner at a location separate from the facility.

- Central stations provide monitoring using a third-party company. They are known for reliability for monitoring alarms and notifying proper authorities.

2. Manage hot work hazards:

Preventing hot work fires requires careful implementation and enforcement of a written Hot Work Safety Program. Management should designate a hot work Permit Authorizing Individual (PAI), who is trained in hot work safety measures and is responsible for issuing permits.

3. Pre-fire planning:

Good pre-fire planning gives the fire department better situational awareness as they can refer to your plan at the time of an emergency. But how does a company create a best-in-class pre-fire plan?

- Provide the fire department detailed information about the business property. This will aid them in conducting their firefighting operations, especially if protective gear or equipment is necessary for fighting fire. Include: floor plans; aerial photographs of the property; the number of occupants; information on electrical, gas and HVAC systems; information on sprinkler and fire alarm systems; a list of hazardous materials in the building; and key holder or responsible party contact information.

- Hold routine fire drills to assure that occupants know how to quickly and safely evacuate the building.

- Identify equipment that needs to be shut down in order to limit damage if there is a fire. Building owners should identify these to the fire department so they understand what to do in an emergency situation.

4. Business continuity planning:

A business continuity plan provides a framework for returning to normalcy following a disaster. It is a key tool in protecting business revenues, your company's reputation, recovery costs, and even people’s lives. It generally covers the following key areas. Make sure your plan includes emergency response procedures for fires.

1 Insurance Information Institute, Facts & Statistics: Fire

2 South Dakota State University. “Large, high-intensity forest fires will increase.” ScienceDaily. ScienceDaily, 10 April 2017.

Insights and expertise

This document is advisory in nature and is offered as a resource to be used together with your professional insurance advisors in maintaining a loss prevention program. It is an overview only, and is not intended as a substitute for consultation with your insurance broker, or for legal, engineering or other professional advice.

Chubb is the marketing name used to refer to subsidiaries of Chubb Limited providing insurance and related services. For a list of these subsidiaries, please visit our website at www.chubb.com. Insurance provided by ACE American Insurance Company and its U.S. based Chubb underwriting company affiliates. All products may not be available in all states. This communication contains product summaries only. Coverage is subject to the language of the policies as actually issued. Surplus lines insurance sold only through licensed surplus lines producers. Chubb, 202 Hall's Mill Road, Whitehouse Station, NJ 08889-1600.