Your home's replacement cost

What is replacement cost and what does it mean?

Your home's replacement cost is the amount it would cost to rebuild your current home, from the foundation up, even for clients who choose to rebuild their homes at another location.

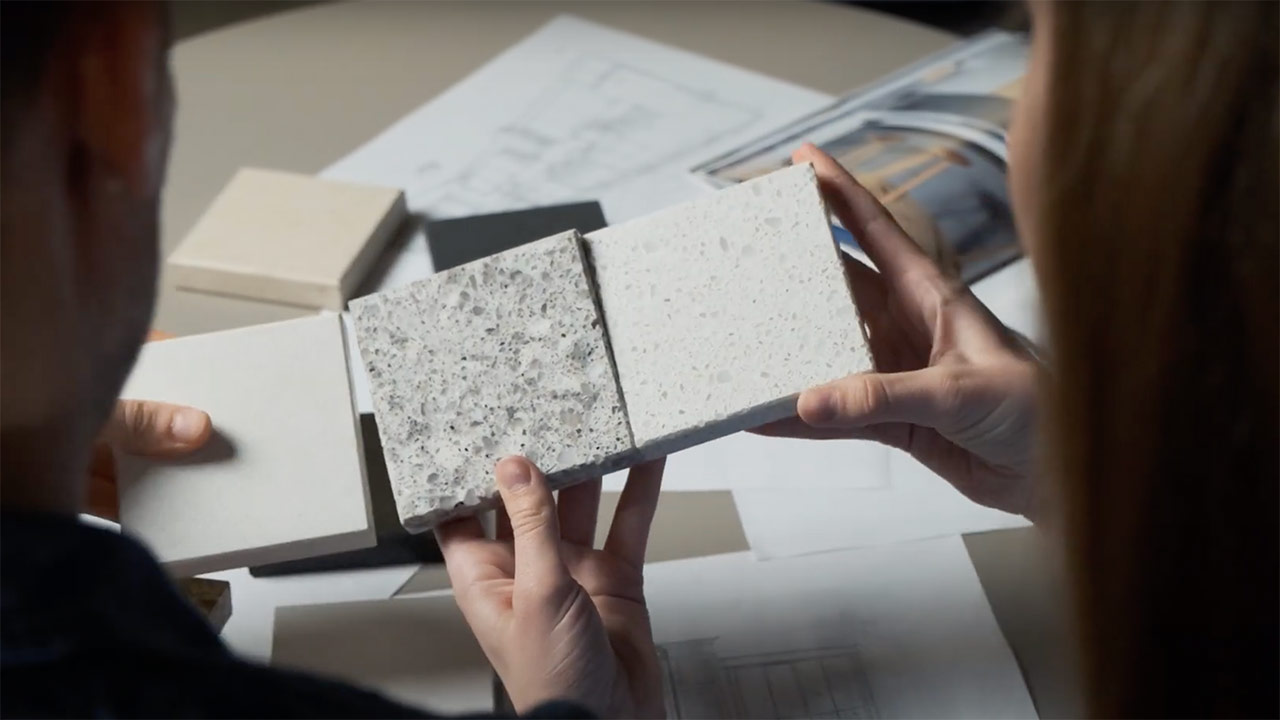

The replacement cost includes the cost to repair or replace at the same level of detail and finishes, considering the cost of things today, such as materials and labor, designers, architects, and other specialists.

Understand your premium

So, if your kitchen is five years old and was damaged in an insured loss, it would need to be replaced with new cabinets, flooring, and appliances—paying today’s costs. In most cases, the replacement cost of the home accounts for all finishes permanently attached or installed in the overall structure of the home. Separate coverages like contents will protect things like clothing and furniture.

Learn more about the factors that go into your insurance premium by logging into the Client Portal and selecting any of the products from the “Understanding your Premium” section.

How we determine a home’s replacement cost

At Chubb, one of the first things we do for a new client is complete a Home Assessment. This detailed analysis, usually performed on site, helps our clients ensure they have the right replacement cost for their home and that what they pay for insurance reflects what they need.

If you’re a new Chubb client and want to learn more about what to expect during a home assessment, visit www.chubb.com/starthere.

The steps we take to determine your home's replacement cost for a new client Home Assessment

- We price out rebuilds

Similar to a contractor's process, Chubb considers various components of construction, including foundation, framing, roof cover, plumbing etc.

- We analyze and interpret

Chubb compares this data with local claims loss trends, as well as information provided through interviews with contractors who specialize in building and restoring high-value homes.

- We conduct research

Chubb considers additional cost factors that go beyond basic inflationary changes in labor and material costs as a result of the customizations and expertise that are often required to rebuild high-value homes. These factors include upgrades, freedom of contractor choice, rebuilding to code and more.

Chubb frequently evaluates cost data from trusted construction & labor industry sources, such as:

- CoreLogic Marshall Swift/Boeckh

- Bureau of Labor Statistics

- Engineering News Record

- RSMeans

- Verisk

Real-world examples that demonstrate the importance of a home's replacement cost.

Historic home nearly destroyed when owner tries to melt ice buildup on roof

“I’m forever grateful that I’m a Chubb client.”

When our client experienced a home fire, see how her coverage helped her rebuild.

Common FAQs

Every year, Chubb establishes an annual Construction Cost Adjustment Factor (CCAF) that we apply to the policy. This annual factor is based on insights from decades of experience and that of other trusted industry sources, localized Chubb claims data, and contractor interviews.

We want to make your claims experience as seamless as possible, so you can repair, restore, and replace all of your home’s details in the event of a claim, without hassle and in as timely a manner as possible. We offer an Extended Replacement Cost option, and when that coverage is included, we’ll extend coverage beyond the policy limits if the cost to rebuild or restore your home after a loss exceeds the limits purchased. We will also pay for upgrades required to keep up with modern building codes, unlike some standard policies.

This also means that what our clients pay for, reflects what they need. And when our client has a claim, it's our policy to make life easier.

Factors that significantly impact the cost to rebuild a custom home include:

- Availability of reconstruction contractors, especially after a catastrophe

- Client urgency to rebuild and get back into their home

- Compliance with updated building code requirements

- Lack of economies of scale on single home reconstruction

- Quality and quantity of custom high-end finishes, features and materials

- Scheduling issues and resource availability

Market value and the replacement value are very different.

Market value attempts to establish what a buyer and seller might agree to as a sale price for a particular home in the current real estate market. This includes key factors such as characteristics of the home, recent sale price of similar homes, volume of unsold homes in the area, location (proximity to areas of interest, crime rate, etc.), property size and land value.

Replacement cost estimates the current cost for material, labor, and other activities associated with rebuilding a home with identical features and components, in the event of a total loss. This includes key factors such as characteristics of the home (size, features, age, access, etc.), current and projected material and labor costs, architect and contractor fees (overhead, profit margin, redraft of plans, etc.) and building code upgrades.

Market value is influenced by factors beyond labor and material costs of reconstruction; therefore the market value and replacement cost can differ significantly, particularly during times when there is a decreased demand for houses and home inventory is high.

Our contract states that we will insure the costs to “rebuild using like design, and materials and workmanship of comparable kind and quality” which means you'll be able to restore those aspects that make your home historic, including features such as plaster moldings and walls, antique flooring, period door and window hardware, custom wainscotting, and more. This coverage permits you to look for matching exterior features like antique brick, cornices, and shutters.

We realize the builder you work with can make or break your construction experience. Our policy allows our clients to choose a contractor of their choice which means clients can select the best qualified historic home builder to meet their needs. They may also use an architect who can help them navigate historic review processes if the house is in a historic district and/or is a local, state, or national landmark that may require oversite if changes are made.

Another benefit of our policy is that it covers code upgrades you might be required to make, such as major mechanical system updates, staircase width, framing and fire blocking and egress windows.

Common FAQs (continued)

Your building’s policy (also referred to as your building’s master policy, building’s association insurance, or homeowner’s association insurance) will generally cover damage if something happens outside the walls of your condo—such as if a storm rips off the siding or a window is damaged. But if there’s damage to the inside of your home, you may be responsible for all or some of the damage. What your building’s policy will or will not cover can sometimes be subject to debate. With Chubb, you can expect seamless claims service.

Additionally, with a Masterpiece Condominium and Cooperative policy, your unit is covered from the “walls in,” even if the building claims responsibility for structural elements.

When you look at the cost to build a home, you may be focused on the builder contract, not soft costs such as architect, designer, and engineer fees or out-of-pocket costs such as smart electrical and audio/visual systems, light fixtures, and appliances. If your project began a few years ago, your budget may not include escalating costs for building materials or labor.

At the time of a loss, we cannot assume that our clients will be able to rebuild their home. If you’re in the industry, you may be able to take advantage of economies of scale and preferential pricing on materials and labor. This is particularly true if your focus is large communities or condo buildings.

- Economy of Scale – When a contractor is building many new houses at once, materials can be purchased in large quantities for delivery as needed, driving prices down.

- "Top-Down" vs. "Bottom-Up" – New construction begins at the foundation and builds upward. Repairing a house that isn't totally destroyed often means removing the roof and rebuilding from the top down, a far more labor-intensive procedure.

- Use of Labor – When a new home builder has several houses under construction, work can often be scheduled for the most efficient use of carpenters, plumbers, and electricians. When only one home is being built, that kind of efficiency is rarely possible.

- Access to the Worksite – With new home construction, there is usually no landscaping, allowing easier access to the building site. When a house is being rebuilt, there are often trees, shrubs, lawns, and other obstructions limiting access. Materials may have to be off-loaded and hand carried to the site, which increases labor costs. Condo/Co-ops also have their own access challenges, including parking issues, elevators, dumpsters and more.

- Special Features & Unusual Materials – Older and extensively remodeled homes often include customized features and uncommon materials which can be expensive to duplicate. Examples include slate or tile roofs, lath and plaster walls, coved ceilings, custom ironwork, ornamented fireplaces, exposed beam ceilings, stained glass windows, curved staircases, and slate or tile roof.

- Building Code Changes – Building codes have evolved over the years to meet higher safety regulations, adopt to new energy efficiency technologies, and respond to the environmental demands of extreme weather. If you are rebuilding or restoring your home, newer, more demanding codes may apply to your home, including undamaged parts of the structure. You may need to replace windows with safety glass or replace roofs with fire-retardant materials. These changes can add thousands of dollars to the cost of a home.

- Construction Costs Rise After Natural Disasters – After a disaster such as a hurricane or fire affects a wide area, the costs of building materials and contractor fees often rise sharply due to the surge in demand. Local supplies are quickly exhausted, so materials have to be brought in on an emergency basis, often from mills or factories at great distance. Skilled labor is also in demand after an event impacting a neighborhood or region. This increases the overall cost of the work as well as the timeline of the project.

- Undamaged Parts of the Home Must Be Protected – Once the fire is out or the windstorm has abated, property that has not been destroyed must be protected from further damage or looting. This can involve covering a damaged roof. There’s an expense and labor cost related to quickly protecting and securing the home and it’s contents from further damage.

Additional Resources & Support

Looking for more information? Take a look at the following resources.