If the insured passes away due to an accident during the 1st – 5th policy year, the company will provide a payout from 200%* to 1,000%* of the sum assured, which will increase by 200% annually. For example, if the insured passes away at the 3rd policy year, the company will pay 600%* of the sum assured. Additionally, in the event of the insured passing away from an accident during the 6th policy year until the age of 78, the company will pay out at 1,200%* of the sum assured.

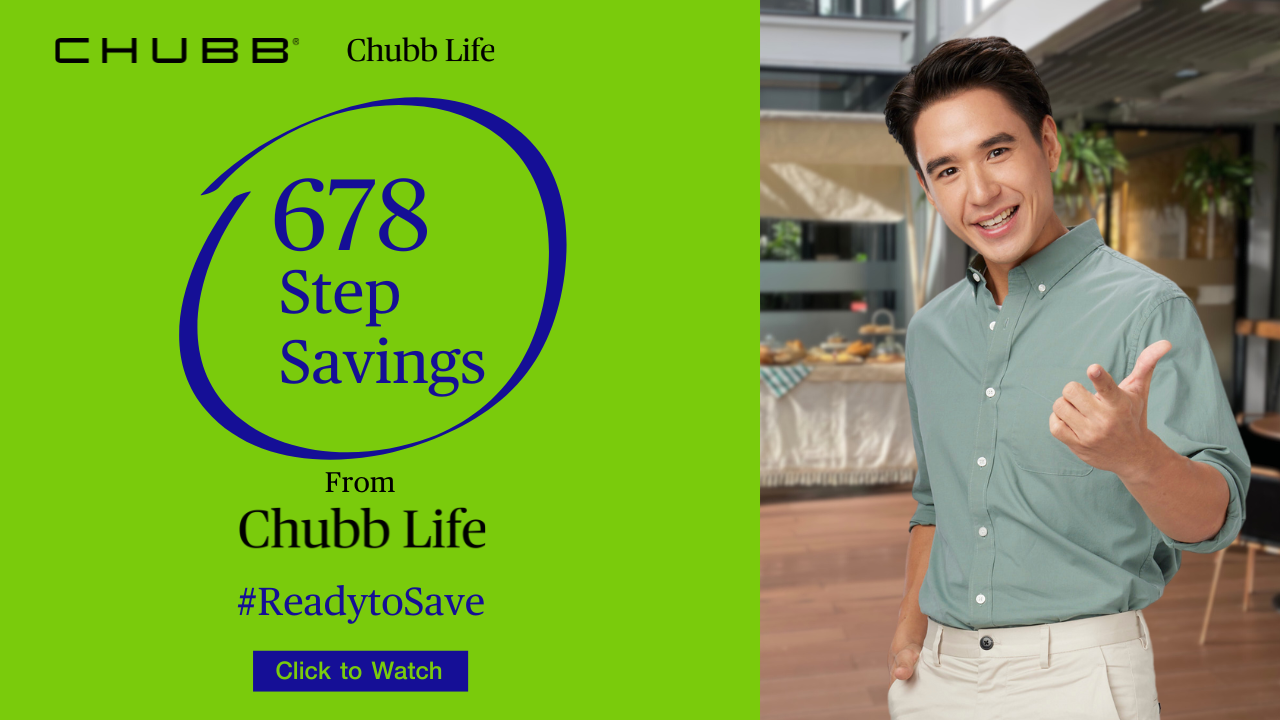

678 Step Savings

Ready to Save.. For the Future

Make every step of your life stable with the savings life insurance "678 Step Savings". Premium payment term is as brief as 6 years and receives long-term coverage until the age of 78. Receive an annual guaranteed return, of up to 11%, and a maturity benefit of up to 600%. Additionally, in the event of an unforeseen accident resulting in loss of life, receive life insurance coverage of up to 1,200%. This will help your family feel at ease for their future.

- Entry age: 31 days until 60 years old

- Minimum sum assured: TH 70,000 per policy.

- Unable to attach with other riders.

- Non-disclosure or misrepresentation of any facts

- Commit suicide within 1 year or intentionally being murdered by the beneficiary.

1. Intentional being murdered or assaulted

2. War (whether declared or not), invasion or act of foreign enemies, civil war, revolution, rebellion, public uprising to the extent of revolting against the government, riot, strike, terrorist act

3. Actions of the insured while under the influence of alcohol, drugs, or narcotics to the point of being unable to control one's mind. The term "under the influence of alcohol" in the case of a blood test means a blood alcohol level of 150 milligrams percent or more.

4. Suicide or self-harm or attempted to do so, whether the insured is conscious or insane

5. While the insured is participating in a fight or inciting a fight

% of the sum assured amount

*or cash surrender value or paid premium deducted by all cash coupons which have already been received from policy benefit, depending on whichever is the highest.

Potential buyers should carefully review the specifics, coverage, and terms before making any insurance purchases. It's essential to note that the insurance will align with the company's conditions and regulations.